Special thanks to Ben Bisconer, CEO of Complete Welders, Scott Myran, President of Mississippi Welders Supply Company (MWSCO), Joe Francis, President and CEO of Central McGowan, and Allen Jezouit, VP Product Management, Meritus Gas Products for their contributions. The content for this blog was published in the October 2022 US Print edition of GasWorld.

Almost three quarters into 2022, industrial gas companies continue to deliver growth in an incredibly challenging backdrop of macroeconomic, geopolitical, and ongoing operational and talent challenges. The Tier one players seem to be performing well under these circumstances delivering strong financial performance, and the US Independent Distributors (IDs) segment also continues to carve out their fair share of growth as well. On one hand, they are more impacted by some of these challenges than the Majors (i.e., talent), but on the other side, their local/regional footprints have enabled them to move faster and react more quickly to changing customer needs. This speed and flexibility have enabled some of the segment’s high performers to deliver much stronger growth performance than the industry average. As a result, we take a closer look at the ID segment starting with market dimensions, segment trends, challenges and opportunities, then conclude with an industry/segment outlook.

Dimensions

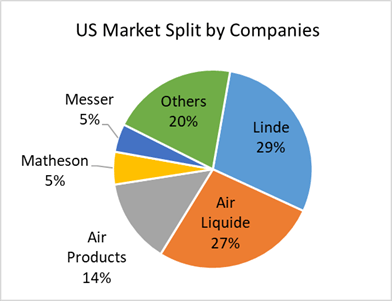

The US is home to the world’s largest industrial gas market with revenues in 2021 of approximately $25-26 billion. The primary producers include:

- Tier One players – Linde, Air Liquide, Air Products, Taiyo Nippon Sanso, Messer-US

- Independent Distributors

- Global & Regional Tier Two players expanding into the US (i.e., Air Water, Iwatani)

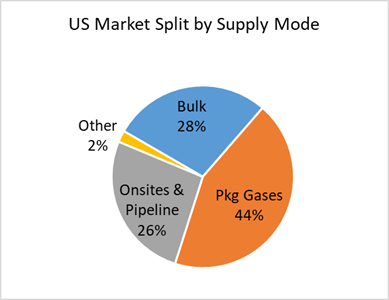

Figures 1 and 2 below show the estimated 2021 US market shares and supply modes respectively (Source – Gasworld Business Intelligence).

It is estimated that there approximately 700-900 Independent Distributors supplying a significant share of the US Industrial Gas (IG) market. Their core portfolio of products includes industrial/specialty packaged gases, Microbulk (small bulk installations), hard goods and safety services. However, they are also extending into adjacent markets (on a local/regional basis) with Dry Ice and CO2 supply, as well as technical/applications support to segments of the beverage market as an example. Some of the IDs have extended their business across multiple regions of the US and a few have established a nationwide presence.

Trends

Business has been strong despite some clear headwinds. The key end-markets served by the IG industry including Manufacturing, Chemicals and Energy, Food & Beverage, Semiconductors, Primary Metals and Metal Fabrication, all had strong performance in Q1 & Q2, contributing to solid performance across the majority of the industry. Tier One player volumes rose 3-4%, and they executed aggressive price increase and surcharge actions across the customer base that recovered most if not all the increased costs from inflationary and energy cost impacts. As a result, sales grew 9-12% in the most recent quarter, and the Majors maintained their guidance for the rest of the year, although economic forecasters (such as the World Bank) and many companies are trimming growth outlooks for the last half of the year.

Most of the growth in the ID segment has been organic in nature, but there is still a steady stream of M&A transactions. It is well-proven that business acquisitions are a savvy way to expand revenue and increase a company’s value quickly, if the fit between the parties is a good one. This activity is being primarily driven by the larger IDs looking to expand regional or portfolio capabilities, or by Private Equity funded entities that are investing to help players scale more rapidly and build capability at the same time. As an example, private equity funded Meritus Gas Partners has made 7 acquisitions since their founding in December of 2020 including Gas Innovations, Atlas Welding Supply Company, Ozarc Gas, Tulsa Gas & Gear, Volunteer Welding Gases & Supply, Mitchell Welding Supply and Specialty Products & Leasing. There has been limited activity by the Tier Ones over the last few years due to constraints imposed by the FTC, except for few acquisitions by Airgas (i.e., Yakima Welding and Adirondack Compressed Gases) to fill some gaps in their geographic footprint, and Tier Two players Air-Water and Iwatani to build out their US portfolio.

The topic of Digitalization has become less of a trend in recent years and more of the “norm.” Whether it is upgrading e-commerce platforms, enhancing logistics planning and scheduling solutions, increasing deployment of IOT (Internet of Things) devices on more trucks, cylinders or tanks, plus many other solutions, it is fast becoming “table stakes” in the eyes of many customers. Their expectations continue to demand greater speed in all areas of doing business, and digitalization is a big part in being able to deliver on those expectations.

We’ve always been technology driven with ongoing efforts to digitize. I do not see that changing as we search for more software solutions to help us better understand everything from customer needs and wants to having proper inventory levels to suport them. We want to stock what is needed and in demand looking forward, not at what historically has been considered proper stocking levels.

Scott Myran, President of Mississippi Welders Supply Company (MWSCO).

Being more data and KPI/Measurable driven is becoming an enabler to being more efficient and customer centric… we’ve put more emphasis on KPI/Measurables, that get measured at all levels of the business, to track performance in many areas of our business to help deliver our products and solutions more effectively.

Joe Francis, President and CEO of Central McGowan

Reshoring of manufacturing is now more than talk by major company executives and becoming a growing trend. According to a study by the Reshoring Institute, in 2021 private and federal support pushed reshoring to add 261k manufacturing jobs….2022 is projected to crest at 400k, a 35% increase over 2021. While the pandemic underlined the need for the movement of critical supply chains back to the US, rising geopolitical tensions between the US and China (in addition to the 25% tariffs), as well as narrowing labor rate advantages are accelerating the reshoring trend. Since manufacturing is a major end-market for the industrial gas industry, this is good news for the ID segment.

The signing of the CHIPS and Science Act in August is but one example of the momentum around this trend. This $280B legislation, which includes roughly $52B in subsidies to boost domestic chip production and an investment tax credit for chip plants, will benefit all the major semiconductor players. Intel is already building two factories outside Phoenix, AZ and went on record that a greenfield factory in Ohio would be contingent on this legislation. Taiwan Semiconductor Manufacturing, the largest chip foundry in the world is constructing one in AZ. Micron Technology announced plans to invest $40B through the end of the decade to build leading-edge memory manufacturing in multiple phases in the U.S., and other companies will benefit including Global Foundries, Texas Instruments, ON Semiconductor, Analog Devices, Microchip, KLA Corp., Applied Materials and Lam Research, among others. The Majors may secure the long term gas supplies for many of these projects, but IDs will play a significant role during the construction and ongoing maintenance phases of these facilities.

Also in August, the signing of the Inflation Reduction Act (IRA) promises some inflation relief for consumers and businesses but also includes some items for the energy transition. Specifically, the increase in the 45Q tax credits for sequestered CO2 provided by the IRA will likely have a substantial impact on CO2 source availability moving forward. We won’t know the full impact until we see what happens as existing sourcing agreements lapse in the coming years.

Allen Jezouit, VP Product Management, Meritus Gas Products

Other industries such as aluminum and steel are seeing plants erected across the south, including Novelis in Bay Minette, Alabama, US Steel in Osceola, Arkansas, Nucor in Brandenburg, Kentucky (Nucor). These industries are fueling orders for air compressors that will be cranked out at an Ingersoll Rand plant in Buffalo, New York that had been shuttered for years. Again, this is all great news for the IG industry and the Independent Distributor segment will get its fair share from these industries and its supplier base.

Challenges

Talent management, rising supply chain costs and product availability are all challenges well known to our industry and have in some cases ratcheted up since the pandemic. So, what have companies and specifically IDs been doing to address these challenges? With respect to Talent, one could categorize the approaches in 4 categories:

- Compensation & Benefits – “refresh” compensation packages in ways that attract and retain employees. There is no perfect way to do this; a lot depends on culture, context, and some trial and error.

We’ve spent time and dollars benchmarking through GAWDA and others to understand where Central McGowan is positioned in the market compared to our peers. As a result, we made several changes including offering 4 day work weeks for Drivers, flexible scheduling for other roles and being even more transparent with our communications about company performance… really building out a culture that centers around our core values…

Joe Francis, President and CEO of Central McGowan

- Make Workplace Attractive – invest in listening to employees, anticipate and address their concerns (i.e., hybrid/remote working options), foster a sense of community, and measure outcomes. As an example, conduct “staying” interviews instead of exit interviews, asking employees (especially those in critical roles) how they are doing and what they need to continue in those roles.

- Expand Search Area – think more creatively about candidates in different talent pools, such as nontraditional workers who are not even on the radar. These include students, “boomerang” employees (those who left), current part-time or contract workers, or even “latent” workers (those not in the workforce at all or have been out for a while).

- Succession Planning – may be viewed as a luxury for many roles but is absolutely critical for those business critical roles as well as for ensuring a smooth transition for each generation of ownership.

As it pertains to the “holistic” supply chain which includes everything from Order intake through delivery of products/services, to receiving payment, costs have gone up dramatically. The Producer Price Index (PPI) in July versus 12 months ago was up 9.8% on an unadjusted basis, but those in the ID space would say that costs have increased nearly 2X that rate. With the majority of the cost stack driven by labor, distribution and energy costs, along with rising cost to replace and refurbish assets, it is easy to see why these costs are much higher.

Price increases, charges, surcharges, etc. are the norm these days, with many suppliers raising prices quarterly if not more frequently. Quickly and accurately adjusting pricing in response to the hyper-inflation of gas supply from the majors and hardgoods supplied by the wedding/cutting/safely suppliers is one of the highest priorities for Meritus partners and I am sure it is at least a very high priority for the independent distributor network at large. Without this vigilant approach to price and cost management, margin quality could easily erode by 500-1000 bps.

Scott Myran, President of Mississippi Welders Supply Company (MWSCO).

Another major challenge and one mostly out of their control is product availability. There are few times in recent history when so many products are in short supply at the same time. Helium is well documented with “shortage 4.0” with significant relief not forecasted till 2023, and carbon dioxide (CO2) seems to be an annual issue across the US (especially outside the Midwest). One solution offered by MWSCO is

Rather than have an in demand product vented to atmosphere I’d like to see CO2 captured at every ethanol plant in the USA. This potentially alleviates some of the CO2 supply chain issue, while reducing greenhouse gas emissions. Availability of CO2 is limiting our growth potential as breweries, bars, restaurants, dry ice users are looking for more CO2.

Scott Myran, President of Mississippi Welders Supply Company (MWSCO)

Argon has been an ongoing challenge for many years in select regions across the US (especially the West coast) due to some locations of significant demand not being near supply sources. Specific specialty gases get tight from a supply side from time-to-time, and currently rare gas supply (i.e., krypton, xenon, neon) have been severely impacted due to the Ukraine/Russia conflict and resulting sanctions, which has reduced supply by 15-25%.

Our ability to successfully pivot, and respond to the swings in pricing and product availability has built solid working relationships with our customers, assuring future business opportunities.

Ben Bisconer, CEO of Complete Welders

Unfortunately, many of these issues primarily sit squarely with the producers of these products including Tier one players, oil & gas companies, ethanol and food companies, etc. Not easy issues to solve…

Opportunities

It is clear that IDs are looking at both organic and inorganic solutions to drive future growth. Although the Majors along with Airgas drove industry consolidation over the last 20+ years, IDs are leading the most recent consolidation activity as mentioned earlier in the article. The smaller Distributors are facing several challenges including but not limited to growing regulatory and complexity of operating the business, increased capital to stay efficient and competitive in the marketplace, and managing succession planning and equity extraction associated with generational transition, just to name a few. This creates opportunities for the medium/larger independents who are looking to extend their geographical footprint or capabilities, private equity that are attempting to build an industrial gas platform of businesses, or even Tier 1 or 2 industry players who have a hole in their geographical coverage and need to fill it.

M&A is part of our growth strategy at Central McGowan. We’ve done a number of acquisitions over the last few years, that have enabled us to build out our CO2 business and expand into new geographies with our other welding, industrial and gas supply options.

Joe Francis, President and CEO of Central McGowan

Each opportunity comes with a different value proposition to the Seller, and as a result, each opportunity is unique. Year-to-date there have been approximately 10-15 officially announced acquisitions of local Distributors, primarily by larger Independents along with a few by the Majors. There was also another 10-15 acquisitions, mergers and divestitures by suppliers in the IG space.

We know and have proven over the years that we can quickly make business decisions that will positively impact our employees and customers, which ultimately lead to opportunity and growth in market share. While we can’t be all things to all customers, we can certainly grow and adapt as our customers do or as we find better ways to provide superior services.

Scott Myran, President of Mississippi Welders Supply Company (MWSCO)

Organic growth is significantly tied to performance of the end market served; however, it also depends on the supplier’s ability to maintain/grow wallet share at existing customers, capture their fair share in the geography served, and offer products and services that are better than the alternative. A perfect example is the fact that increasingly IDs are being the “first movers” in fast growing segments of the Food and Beverage market such as small breweries, wineries, and beverage producers who have unique and customized dispensing, gas blending and related equipment and services requirements.

We know and have proven over the years that we can quickly make business decisions that will positively impact our employees and customers, which ultimately lead to opportunity and growth in market share. While we can’t be all things to all customers, we can certainly grow and adapt as our customers do or as we find better ways to provide superior services.

Scott Myran, President of Mississippi Welders Supply Company (MWSCO)

Organic growth is significantly tied to performance of the end market served; however, it also depends on the supplier’s ability to maintain/grow wallet share at existing customers, capture their fair share in the geography served, and offer products and services that are better than the alternative. A perfect example is the fact that increasingly IDs are being the “first movers” in fast growing segments of the Food and Beverage market such as small breweries, wineries, and beverage producers who have unique and customized dispensing, gas blending and related equipment and services requirements.

We see these challenging market conditions as a unique opportunity to develop new skills to better serve our customers, as we embrace these challenges head on.

Ben Biconer, CEO of Complete Welders

Outlook

Despite all the economic headwinds facing our industry, the Majors have maintained full-year guidance for the balance of 2022, with earnings growth in the range of 10-14% above 2021. We do not have this level of detail for the ID segment; however, this range is consistent with GAWDA’s annual survey of members and their projections for growth in 2022, which ranged from 6-12%.

As mentioned earlier, many economic forecasters and companies have lowered (or are starting to lower) US manufacturing forecasts for the last half of the year, due to a variety of factors (i.e., inflation, slowing/shifting consumer demand, declining housing starts/purchases, continued but lessening supply chain volatility, etc.). Since the IG historically lags the overall economy by 1-2 quarters, this explains why the Majors have not lowered their targets. However, one thing for sure, everyone is aligned that 2023 will be more challenging than 2022.

In summary, the ID space has carved out a solid and growing niche of the market, that the Majors either do not target or have difficulty in meeting the unique customer requirements of small manufacturing and service companies. As a result, the value proposition of this segment connects well with the needs of this customer segment and will yield solid growth for the foreseeable future.