In recent years, large mergers and acquisitions (M&A) activity in the industrial gas industry has been constrained due to the market share positions of the majors. In 2025, the “top four global players” had announced between 12 and 14 acquisitions – largely “tuck-in”– in addition to a handful of divestitures.

However, despite slower activity among the majors, there has been increased activity outside of this group and in related segments, including equipment and service providers, such as gas compression and component manufacturing, as well as in the energy and oilfield services industries.

The Chart Industries and Baker Hughes transaction was a key one to note here. In October, shareholders of US cryogenic equipment manufacturer Chart Industries approved its sale to global energy company Baker Hughes in a $13.6bn cash deal.

There has also been a continued and steady consolidation among US independent distributors, largely driven by both larger regional players and private equity-sponsored companies.

Private equity is gaining traction as it garners increasing market share, while offering independents some additional options to fund investment and growth.

In this article, we take a closer look at private equity trends in the industry, insights from key players, and share an outlook for this space.

Trends

Private equity’s interest in the industry is not new. Its origins date back nearly 20 years, with transactions initially focused on the equipment/service providers, including cylinders (Kanto, 2007), storage equipment (Taylor-Wharton, 2007), equipment and services (BOC Edwards, 2007), and components and services (Acme Cryogenics, 2006).

Following this, US-based distributor Airgas employed a “private equity-like” model and acquired over 125 businesses over a nine-year timeframe between 2006 and 2015 prior to its acquisition by Air Liquide in 2016.

This approach made private equity more comfortable and visible in its pursuit of complete industrial gas companies. Several global and US-based transactions followed, including PAG Capital’s acquisition of Yingde Gases, Warburg Pincus’s investment in BaoSteel Gases, MBK Partners’ acquisition of Daesung Gases from Goldman Sachs, CI Capital’s acquisition of Tech Air, CVC Capital’s partnership with Messer Group, and several others.

Today, private equity has broadly continued to grow, evolve, and become more efficient, as its presence across sectors expands. Deal activity and investment value have consistently grown, especially in large US transactions. This growth has been driven by private equity firms not only providing capital, operational expertise, and strategic direction to a wider range of companies, including those that are established, struggling, or rapidly growing.

Specific to industrial gases, it has now become the norm for some companies to cycle between private equity and industrial gas ownership as they grow.

An example is Daesung Industrial Gases (now DIG Airgas), which transitioned from being independent to MBK Partners ownership, then to Macquarie Asia-Pacific ownership, which subsequently sold the company to Air Liquide in August 2025.

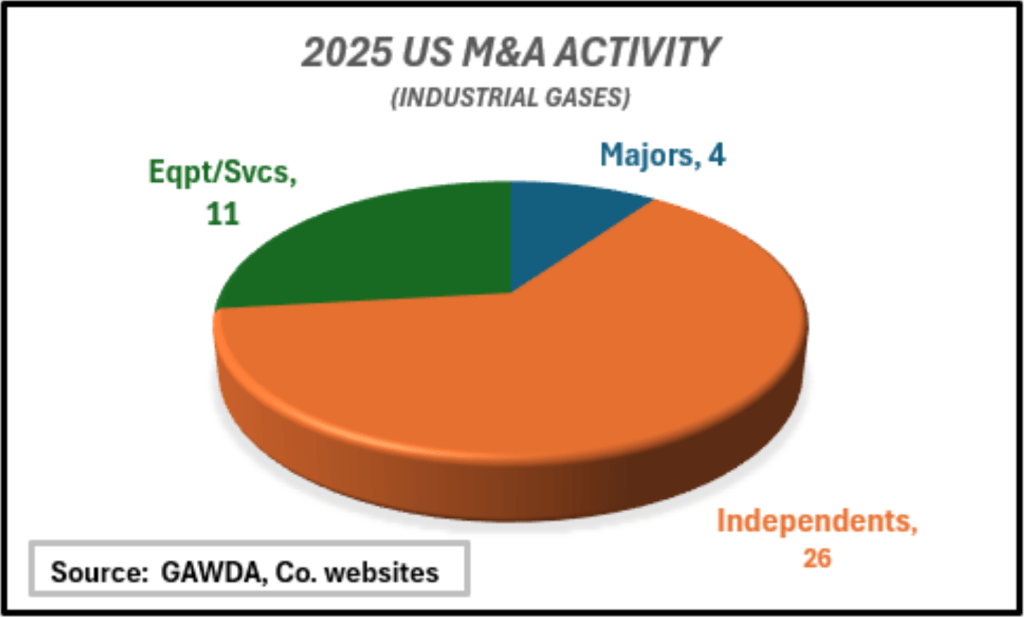

Another trend, albeit on a smaller scale investment-wise, but larger in the number of transactions, is the private equity focus on packaged gases, distribution networks, specialty gases, and related equipment and services. In 2025, particularly in the US, there was a modest level of M&A activity across the industry, with close to 40 transactions publicly announced and close to 25% of them private equity-backed. The private equity percentage has been consistently growing since the global pandemic.

Meritus Gas Partners

In the US, Meritus Gas Partners is one such option. The business is a portfolio company of AEA Investors Small Business Private Equity. It continues to assemble a national network of independent distributors of industrial, medical, and specialty gases, as well as welding and safety supplies, located in diverse geographies and serving growing end-markets.

The rise of Meritus Gas Partners in the US industrial gas market has been well documented and has been widely viewed as a “new” benchmark in platform building within the industry. The distinction lies not in the number of companies (30), their presence in 20 states, or their consolidated revenues, but in the business model they have employed.

Meritus’ unique approach is underpinned by the long-term strategy of becoming the first national independent distributor. It is assembling entrepreneurial family businesses, while preserving their legacies, brands, and cultures in the process.

Meritus also supports its partners with technical expertise and financial investment to help support growth in local markets. As part of this, it also offers co-investment to sellers and their employees to build alignment with its strategy and goals across its network.

With this approach, Meritus says the partner companies are much more than independent entities operating under the same umbrella, but rather partners.

Our model is unique and compelling to owners,” states Rob D’Alessandro, President of Meritus. “While we allow our member companies to continue to operate independently under their legacy brands, the glue which holds us together and aligned is common ownership. Nearly half of our equity is held by our management team, many of the owners who sold their businesses to Meritus, and nearly 300 employees.

D’Alessandro explains that AEA defers the management of the company to its Meritus leadership team. Given AEA’s hands-off approach and significant investment by individuals, he says Meritus is not a typical private equity affiliated company.

Scott Kaltrider, CEO of Meritus, says the company wants to build a $1bn to $2bn business with a national footprint that can compete with the majors.

“Our intent is not to build and flip, but instead to build a continuing enterprise which will leave a lasting legacy in the industry,” he adds. “While our PE sponsor may have a shorter-term horizon, we expect to recapitalize multiple times over Meritus’ life to sustain the company and achieve our collective goals.”

Missouri-based Ozarc Gases is one company that has partnered with Meritus. The business is a third-generation independent distributor that has expanded over the years.

Ozarc began conversations with Meritus shortly after the pandemic, with key considerations of financial stability, culture preservation and legacy in mind, and moved forward in partnership.

Since the acquisition, Ozarc says its revenues have nearly doubled, the portfolio of products has been expanded, and the overall quality of the business has greatly improved.

“One of the most rewarding and unexpected aspects of this venture has been the immediate sense of camaraderie among the partners,” says James Garner, President and CEO of Ozarc Gases.

Falcon Gases

One of the new players entering the US industrial gases market is Falcon Gases. Falcon formally announced its entrance into the space in September 2025, stating the simple mission of building a world-class packaged gas business, made up of the highest quality distributors, managers, employees, and customers.

But what will differentiate them from others in the marketplace?

Falcon believes their strategy is a key to their success.

Our approach will start with maintaining the unique local touch that’s made each business successful. That said, our overall vision is not just to buy and hold from a distance, but to work closely with owners and operators to invest and build for long-term, sustainable growth. We plan to actively help them grow their individual businesses, while they help us shape the broader Falcon platform,” states Pete Jeffe, CEO of Falcon Gases.

Another differentiator is flexibility. Falcon believes each partnership is not a “one-size-fits-all.” Falcon plans to leverage its position as a new player to approach each business’ unique needs with flexibility in how deals are structured and how they grow.

Lastly, Falcon believes its veteran team is a key strength. They not only have deep experience in packaged gases, but also a track record of doing deals and scaling businesses from scratch successfully. This unique combination makes Falcon a value-add partner to independent distributor owners, having not only run independent distributors but also having previously gone through the process of building partnerships and scaling over time. On the acquisition front, the team has executed over 20 packaged gas acquisitions and an additional 40 mid-market deals.

The private equity company behind them is Tailwind Capital, a private equity firm with over 20 years of experience that pursues a sector-focused approach to investing in lower middle market industrial and technical service companies in the US. Since its inception, Tailwind has invested in over 50 portfolio companies and over 250 add-on acquisitions, and they plan to support Falcon Gases to help build a leading independent distributor in the market.

“Falcon has gotten a great reception in the market. Our team and strategy have resonated with owners and operators, many of whom we’ve known for years. This has yielded a large, active pipeline. Folks are excited about the opportunities that come with building a new platform from the ground up,” states Chris Granger, Chief Commercial Officer. “Being a new entrant gives us unique flexibility and runway.”

Independent distributors

The US has largest concentration of independent industrial gas companies, representing around 10% of the market. Many of these companies are family led and multigenerational, which often gives them a longer-term perspective when considering growth, investment, and team development. As a result, some independents may not be suitable for – or interested in – private equity participation.

One example is Haun Welding & Specialty Gases, a regional distributor operating in 23 locations. The company is currently run by its fourth generation, and the business has grown consistently since the current owner’s great grandfather started the business in 1958. The company’s approach has been one of steady growth, looking at a variety of factors such as geography, competition, existing infrastructure and people to build density in its operational footprint utilizing both “scratch starts” and acquisitions in the process.

We are in a good place with respect to access to capital and family involvement in the business, states Joshua Haun, Co-President of Haun Welding & Specialty Gases. If an independent is challenged in one or both of those two areas, that is clearly where a private equity firm could assist.

Not every distributor is in the same position as Haun Welding & Specialty Gases, and as a result, private equity approaches continue to attract interest. Added to that, business owners are getting older, with some not having a clear succession plan, resulting in some being willing to give up some control to access the necessary resources and capital to secure their businesses for the long term.

Outlook

Private equity has become increasingly active across end-markets, and industrial gases is emerging as one of them. Private equity ownership can influence operational practices through governance, systems, and workforce management. In the industrial gases sector, companies exiting private equity ownership are increasingly being acquired by major players or larger private equity firms. Broadly across private equity in the US, with interest rates down from 2024 and 2025 highs and the possibility of more rate cuts to come, the private equity market could be positioned for further momentum in new acquisitions and exits in key sectors. Specific to the US industrial gas market, the private equity outlook continues to be positive over the near term, driven by stable and consistent growth across the industry.

Average annual growth rates are forecasted to be between 2% and 4% over the next three to five years, with certain geographies and sectors delivering 1.5 to 2.5 times those levels. From what we are seeing across the market, private equity interest in the industrial gas sector is likely to persist.

The industry’s track record for consistent performance and profitability continues to underpin that interest, and an improving macroeconomic backdrop would only strengthen it further.