Special thanks to Abydee Butler Moore (Butler Gas Products), Brad Dunn (CK Supply), Bryan Keen (Keen Gas), Brad Peterson & Troy Elmer (MWSCO), Nicole Kissler (Norco), Eric Wood (OE Meyer), Tom Garrity (Compass Point) and Maura Garvey (Intelligas Consulting) for their insightful contributions.

Public companies across all major industries (i.e., Apple, Microsoft, NVIDIA, etc.) dominate the business news cycle, however, it is clear that family-owned businesses are the backbone of the American economy. Studies have shown that as much as 35% of Fortune 500 companies are family-controlled and represent the full spectrum of American companies from small business to major corporations. In addition, they account for 64% of U.S. gross domestic product (GDP), generate 62% of the country’s employment, and account for 78% of all new job creation, according Family Enterprise USA’s most recent surveys in 2023 & 2024.

Although, family controlled businesses have a significant impact on the US economy, many do struggle to successfully transition to the next generation. According to the Family Firm Institute and other sources, approximately 30% of family businesses typically make it to the second generation, that number drops to 12% for the third generation, and 4% in the fourth generation. So, the question may be asked, how do 3rd/4th generation businesses not only survive but continue to grow and thrive in an ever increasingly competitive market environment? This article attempts to answer this question by digging deeper with successful multigenerational businesses serving the industrial gas segment of the chemical industry. They will share some of their secrets of success and best practices that have been incorporated in the running of their businesses. The portions of this article were published in the July US print edition of Gasworld magazine.

History

When you think of a family-owned business, you may imagine the occasional small “mom-and-pop” store, but many family-owned businesses have existed for centuries, predating modern corporations. One of the oldest continuously operating family business in the world is Hoshi Ryokan, a Japanese hotel, hot springs and spa that has been owned and run by the same family since the year 718, spanning 46 generations. Marchesi Antinori is an international wine maker started in 1385 that has spanned 26 generations and was recognized by Drinks International in 2023 as the world’s most admirable wine brand! In the United States, there are farms in Virginia and New England that were established in the 1600s and are still operating today, with one notable example in Virgina that has been in the same family since 1613 with the 11th and 12th generations still living in the home and working the farm. Manufacturing-wise, Bard Manufacturing, an international leader in the commercial heating and cooling industry, started in Bryan, OH over 110 years ago and is currently led by 4th generation family members.

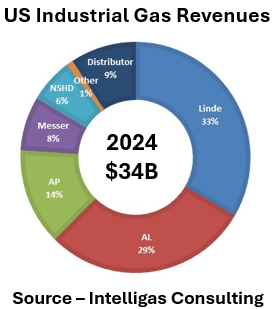

Specific to the industrial gas industry, many regions around the world have a significant portion of their markets supplied by private or family-owned businesses, and the US is no exception. According to Intelligas Consulting, almost 10% the US Industrial Gases market has been consistently served by Independent Distributors.

If you go back 10 – 15 years, you’ll see that Independent Distributors always claimed a significant portion of the US Market,” states Maura Garvey, President of Intelligas Consulting. “It has declined from close to 15% in 2015 due to acquisitions by the major gas companies. Meanwhile there was also consolidation amongst Independent Distributors and increased private equity participation.” However, the overall size of the Independent Distributor business is more than just gases revenues. Garvey noted that “the hardgoods side of the business, not included in the gas revenues, is just as large as the gases revenues in many cases.

This segment of companies are largely family controlled/led businesses and also contain a significant portion that are multigenerational in nature. It is this subgroup of companies that we engage to gain a better understanding of their secrets of success…

Models of Success

As mentioned, almost every region of the world has family-controlled or family-led independent distributors that have been operating successful industrial gas businesses for many decades in places such as Japan, Korea, Southeast Asia, Australia, the Middle East, Africa, Europe, South/Central America and Canada. However, the US has probably the largest concentration of Independents partially due to the size and geographic breadth of the market. The larger industrial gas players are clearly present in all the major US markets, but many Independent Distributors have carved out significant segments in these markets due to their local/regional focus, ability to provide tailored and more agile services and offer quick adaptation to customer needs.

Butler Gas Products

It all began in 1938 in Reading, Pennsylvania, with the entrepreneurial efforts of two brothers, John A. (Jack) and Thomas G. (Tom) Butler, who started a gas and welding supply business and named it Compressed Cylinder Gases. The inspiration came from their father, John T. (Dandy) Butler, who owned and operated a compressed gas company near Pittsburgh, Pennsylvania. In 1948, Jack moved to New Brighton (outside Pittsburgh) with his wife Millie to open what was envisioned to be a Butler Cylinder Gas branch operation. The partnership remained intact but in the early 1950’s, both companies established their autonomy, and Jack and Millie proceeded to name their business Butler Gas Products.

Business improved steadily and in the early 1970’s, Butler Gas Products purchased Dandy’s National Cylinder Gas and acquired its Pittsburgh business. By 1975, Jack’s son, John T. II (Jack), began taking responsibility for running the company, but unfortunately his father developed cancer and relied on young Jack to quickly earn leadership of the business. Jack Sr. died in 1977, and his son Jack purchased the company and became President at age 25.

In the 1980’s, Jack’s sisters, Barb and Debi, and wife Elissa joined him in the efforts of continuing the vision and pivoting the company’s direction due to the declining steel industry in Pittsburgh. The company then restructured and focused more on medical and specialty gas markets, starting a specialty gas division and began filling and analyzing pure gases and specialty mixtures. As the business grew, they steadily reinvested in the business implementing cylinder barcoding, palletization, and automating fill plants to improve service quality, shorten lead times, and increased safety, all while adding locations. In 2015, Jack’s sisters retired and Jack’s daughter Abydee (3rd generation) purchased the minority shares of the business. After roles of increasing scope and responsibility, Abydee was named President in 2019 and CEO in 2021 continuing the vision of Butler Gas Products.

Several lessons learned have been passed down during the Butler Gas Products journey but the importance of planning and governance may be near the top. One thing successful businesses have in common is the presence of a strategic plan, and Butler Gas Products is in the midst of their 100 year Strategic plan. They believe it is important for all stakeholders to know where the business is going and contribute input to help ensure the right steps are taken to achieve their goals. “Our 100 Year Plan was honed at Texas A&M’s Total Quality Management School in the 90’s by the 2nd Generation, to show Butler Gas’ long-term vision and resiliency,” states Abydee Butler Moore, President & CEO of Butler Gas Products. “The plan is a 100% commitment for Butler Gas ownership to steward the business, grow the company, develop our people, and engage in the industry, demonstrating commitment to our people, our customers, and our suppliers.”

In addition, being actively engaged in the communities where you operate, actively participating in key industry associations (i.e., GAWDA, IOMA, CGA, etc.), and being active members of the local family business (FB) ecosystem, provides access to peer-level networking and connections as well as access to best practices to help their business improvement efforts. Another best practice is fostering a “family-oriented” culture that is fully aligned with the desired business outcomes.

The unique vibe of family and friends working together builds a team chemistry that is hard to match,” states Abydee Butler Moore of Butler Gas Products. “Long-term thinking and generational re-investment in the business, coupled with a high-trust, high-ideological-conflict environment dedicated to doing right by people, both employees and customers, creates a sustainable competitive difference in the marketplace, and provides a great place to work.

CK Supply

The St. Louis-based company, opened for business on Nov. 3, 1948, as a distributor for National Cylinder Gas Company, founded by Ralph Chase and Ralph Knight, deriving the name CK Supply by using the “C” from Chase and the “K” from Knight. In 1955, Paul Dunn became the sales manager for CK Supply and shortly thereafter he and his wife Mim Dunn purchased all of the stock of CK Supply by selling their house and borrowing money from friends and family. Now, over 70 years later the ownership still remains within the 3rd generation of the Dunn Family and the employee owners of CK Supply Inc.

Starting with 3 employees, CK Supply experienced consistent growth for the next few decades resulting in moving to a bigger location along the way. Paul Dunn retired in 1979, and his son, Tom Dunn, took over as President of the company and focused on growth and adoption of new technology. During his tenure, multiple expansions were completed to support growth and the addition of three branch locations (west of St. Louis) and two more in Illinois to better serve their customers.

Around this same time Tom Dunn elected to promote Ned Lane to President as he moved into a CEO role. This allowed the two leaders to divide the leadership tasks into two areas around operational and financial discipline and a culture built on family values. In 2012 Brad Dunn (3rd generation) joined the company full time after spending time working for two other independent family owned gas distributors during college and graduate school. He initially focused on the launch into dry ice manufacturing and the expansion of its geographic foot print into Joplin, Kansas City and more recently Columbia, Missouri.

In 2020, Tom Dunn officially retired as CEO after 49 years of service and Ned Lane became President & CEO. As part of his succession plan in 2021 Tom announced the formation of a new Employee Stock Ownership Plan (ESOP) designed to provide 49% stock benefits to its 135 employees. Business continued to grow organically along with some acquisitions and in March 2025, Brad Dunn was named CEO, Tony Ruppel, an outside non-family President was hired and Ned Lane moved to Chairman of the Board. The third generation of the Dunn family are owners and employees in business.

One of the keys to success for my dad (Tom Dunn) was identifying that the overall growth and success of the business can be served by an outside leader,” states Brad Dunn CEO of CK Supply, “while allowing the next generation to develop skills and prepare if and when they earn the opportunity steward the business through ownership or leadership.

In CK Supply’s case, that was done by Tom in bringing in Ned Lane for a period of time, and at the appropriate time transitioning leadership to his son Brad. This Governance around transition, which can be viewed as a recommended best practice, involves an honest assessment of skills and passion of the candidate(s), balanced with the company’s long term focus and sustainability, enabling the transition plan to go smoothly.

In their case, they utilized their Fiduciary Board of Directors which contains both external and family representation to provide a more objective and balanced outcome. In addition, several years in advance of Tom’s planned exit, CK Supply utilized an outside consulting company to formally work on the leadership and ownership transitions, utilizing a variety of tools including the formation of a governance structure, 360 personality and leadership assessments, personal and professional development plans and many other tools to help form an objective view of risks and opportunities for decision making. “Succession planning and leadership transition is often a fragile and stressful period of time for a business and its leaders,” states Brad Dunn of CK Supply. “By the time you get around to a 3rd generation business there is a large responsibility to protect the culture, legacy, customer and employee commitments that is bigger than any one person. It is important to get it right and put a framework in place of regular performance management and governance.”

Another best practice CK Supply would recommend is the implementation of an Employee Stock Ownership Plan (ESOP), but they also would acknowledge that it may not be for everyone. Tom Dunn recognized that an ESOP provided a way to help preserve legacy, culture, and reward the “work family” in helping to grow the business. Tom referred to it as a “WIN-WIN-WIN” as he obtained his desired exit, the company received financial tax benefits as well as cultural, recruitment and retention, and employee owners received a new long term wealth building plan. “Full or Partial ESOPs are not for everyone however, for those that are exit planning it is essential to add this option to the consideration list due to the many unique benefits they offer,” states Brad Dunn. “Moreover, ESOPs are often misunderstood and underappreciated and for those that place value in the preservation of the legacy and culture, while also want to be monetarily rewarded for a successful career, there is no better option in my opinion.”

Keen Gas

Stanley Keen, opened Keen Auto Parts in 1919 in Wilmington, Delaware and about ten years later introduced gases into the business selling acetylene and oxygen cylinders. As the business grew they expanded the facility, added propane to the portfolio and formally changed the name to Keen Compressed Gas Co.

After moving to a new location, Willard Keen Sr., became the 2nd president in 1957, and eight years later J. Merrill Keen became the 3rd president. During his tenure, the business grew significantly both organically and through acquisition adding 10 locations and expanding deeper into the Tri-State area of Delaware, Pennsylvania and New Jersey, and moving into Maryland. “One of my dad’s first and biggest moves in 1969 was buying a local competitor, Anchor Welding,” states Bryan Keen, President Keen Gas. “At the time Anchor Welding was bigger than Keen Gas, and it gave us some size a scope and allowed us to realize what we could become. It also connected us to the Airco distributor network, which invested time and resources into helping distributors grow market share. Fifty-six (56) years later we still enjoy that relationship through Messer, our primary supplier of our bulk gases.”

In 2000, he transitioned the business to his son Bryan who became the 4th President, and has continued the growth trajectory. The company’s portfolio has expanded as well with investments in Microbulk capabilities and construction of a new automated fill plant just before they celebrated their 100th anniversary in 2019.

My father, grandfather and I have all run the business slightly differently due to the market conditions at the time,” states Bryan Keen of Keen Gas. “My grandfather ran and grew the business with virtually no debt through the 50s/60s (slow/steady), and my father focused on organic growth but also expanded via acquisition into new territories. My strategy has continued along the lines of my father’s strategy for growth, but has also involved significant reinvestment in capabilities and diversification into new end-markets.

One of the common themes across the generations has been their commitment to Total Customer Satisfaction (TCS) for both external as well as internal customers (or other employees). They adopted the TCS slogan in the early 1990s, and they still use it today in their Mission and Vision statements, ensuring that they don’t forget the core values based around the customer. They understood that there is a tight link between how you treat your employees and how they take care of your customers. Another common theme is that they understand the driver of customer satisfaction is every employee’s commitment toward personal accountability, hard work and passion for the business. There’s no substitute…

One best practice (BP) is the use of Strategic Planning (SP) as a key element to help fuel their growth. It helps them to continue to plan long term for the company’s investment in capital and people. This process/skill cascades down to each Branch which also does SP at their level. And finally, each employee is encouraged to do their own SP on a personal basis thinking about what they want to be doing in 3-5 years. Theoretically, all of these plans tie together and keep the company on a path for long term growth and financial stability.

One step in operationalizing their SP is the utilization of KPIs (Key Performance Indicators). They measure both strategic and high-level KPIs, as well as near “real-time” financial performance on a branch/customer level. The KPIs continue to evolve, with measuring more things more frequently, retiring other “less impactful” measures, and working to make the organization more data-driven operationally.

One final BP is leveraging peer networking/advising organizations to help improve. Keen Gas is part of the Messer Distributors Group which provides BP sharing and networking opportunities to enhance their business, and they are part of Trend Leaders which is an organization of Independent Distributors that meet twice a year to share BPs and trends within their regional businesses and nationwide. “In addition, various levels of personnel within Keen Gas have been involved in GAWDA. My experiences on the Board, Executive Committee and eventually as President of GAWDA in 2012 – 2013 was a fantastic experience” states Bryan. “The events and personal relationships established have been very beneficial in helping us to stay abreast of the latest industry trends.”

Mississippi Welders Supply Company (MWSCO)

The company was originally founded in 1939 and then purchased by Don Peterson and two partners in 1973. Don left a promising sales career with Airco, a major gas producer, to get into the distributorship side of the industry, and within a decade had bought out his two partners. Under Don’s leadership, MWSCO (Mississippi Welders Supply Company) grew from a single location to four–each of them located along the Mississippi River in either Minnesota or Wisconsin.

In 1991, Brad Peterson (2nd generation) joined MWSCO, having completed four years of college and eight years of active duty with the US Navy. He took on ever-increasing levels of responsibility and was named president of the company in 1997. Under Brad’s leadership, MWSCO vastly expanded its territory and increased its branch count from four (4) to twelve (12). Brad also convinced two talented siblings to join the business: Jeff, in 2001, to run and modernize the fill plant; and Jane, in 2015, to bring her wealth of technology experience and expertise to the IT Department.

With the business continuing to grow in both size and complexity, a slightly larger leadership team began to make sense. Brad moved to the role of Chairman and its longer range, bigger picture job description. Long-time employee, Scott Myran, was chosen as the new president and quickly brought his broad set of talents to the position, which involved overseeing day-to-day details. The advantages to this arrangement soon became apparent: the third generation was nowhere near ready to get involved, tasks could be divided, and there was more chance for discussion as decisions were made. “This change allowed me the bandwidth to think more about acquisitions, infrastructure improvement, and other strategic initiatives,” Brad Peterson, Chairman of MWSCO says. “It also paved the way for greater involvement with GAWDA, IWDC, and the initiative that led to Absolute Air. Absolute Air is a partnership of 5 distributors, who came together to build an air separation plant to serve our respective needs and additionally the larger marketplace.”

An unwritten rule at MWSCO is that any family member interested in working inside the company must first work outside the company. “There are models which work for some distributors where the next generation steps right in after growing up in the business,” states Brad Peterson of MWSCO. “But in our case, all of the 2nd generation went off to college and worked in other careers. It was after that experience that Jane, Jeff and I brought our skills back to the family business, and it has served us well.”

What hasn’t changed as the second generation of Petersons has taken the reins at MWSCO is an unwavering focus on customer service and healthy growth through that service. It was the top priority for Don in 1973, he instilled it in his children–even as they were sweeping floors and painting cylinders–and it’s become such a deeply ingrained part of the culture of this business that it shines in every decision made by every leader, whether family or not. “As we’ve grown, we have more people in place and are more organized in our growth plans.” states Brad Peterson. “With those people and our service orientation, we stay on the leading edge of new technologies, new equipment and new geographies to maintain and extend our position in the marketplace.”

Now, as the third generation is still off-stage, and the business is led by its second non-family president, Troy Elmer, the company continues to grow and plan for long-term permanence. The first 85 years were just a start, and likewise 52 years of Peterson family ownership are setting the stage for a much longer run. “Our long-term investments continue unabated, and we don’t see any slow-down in our progress” concludes Brad.

Norco Inc.

The company was founded by David Nordling in 1948 as the welding supply division of the Nordling Auto Parts Company in Boise, Idaho. In 1968, Larry Kissler, who had served as a Regional manager in the northeast for Linde, headed west with family to purchase Norco. At the time, Norco had two locations, in Boise and Twin Falls, Idaho, and 15 total employees.

Larry with the help of employee number 16 (Dan Steele), who rose through the organization quickly and eventually becoming President, worked together to expand the business by acquiring other welding supply distributorships in the Intermountain West region. At the core of the business model was providing excellent customer service, and they were so committed to the principle that they symbolically placed the customer at the top of the organizational chart. And as Norco grew they also extended their portfolio beyond traditional welding and supplies, into the supply of medical oxygen and related equipment, and special gases.

In 1985, after completing the necessary prerequisites to the lead the company, Jim Kissler (2nd generation) was named the CEO and purchased Norco. He continued the same growth trend as his father while upholding the same doctrines (i.e., focus on customer service). He extended Norco’s footprint into adjacent states, and became more self-sufficient by constructing two air separation plants in the early 2000’s to serve their internal needs as well as their customers, with former President, Ned Pontius leading the projects.

In 2015 the Kissler family formed an Employee Stock Ownership Plan (ESOP) providing a third of the company in the form of stock to its 1,200 employees. At the time, it was one of the largest privately held companies to offer this kind of benefit. This type of benefit aligned perfectly with the culture that was in place. “My grandfather (Larry Kissler) always said ‘people are the key’ and my father (Jim Kissler) continued to emphasize that approach,” states Nicole Kissler, CEO of Norco. “Our team has always had an ownership mindset, and now that they are owners, they continue to serve and support one another and our customers with a sense of purposeful pride.”

One of Norco’s best practices is their approach to succession planning. In 2021, when Nicole Kissler (3rd generation) took the helm as Norco’s CEO with her father Jim moving to Chairman of the Board, she had to achieve certain prerequisites to be able to lead the company similar to her Dad over 30 years earlier. “I spent time in the business at an early age, cleaning the breakroom to earn some snacks, and worked at Norco for a few summers before college,” stated Nicole Kissler of Norco. “Our family has guidelines in place in order to be a part of the business, and after college it is important to work with another company or in another industry for at least 3-5 years. I worked outside the business in Retail management and for an Independent Distributor (Central Welding Supply) in Washington state before joining Norco.” It’s that broad external perspective along with passion for the family business that Norco understands will help start the journey towards leadership in the business.

You can’t talk about best practices or foundational principles being employed at Norco without mentioning “Kissler’s Keys.” Many of them are part of the fabric of the organization today including being customer-focused, building relationships, asking for help, and learning from mistakes in order to always get better. “The mission is still the same today, serving ‘You’ better,” states Nicole Kissler. “The ‘You’ is not only our customers, but our employees, our vendor partners and our communities. In addition, we are committed to the communities we serve, as a part of living and working with purpose and contributing to those through the Kissler Family Foundation.” Norco shares copies of both Kissler’s Keys and their Strategic Vision with Norco Employee Owners, and the principles live on today with their employees and for future generations.

OE Meyer Co.

The company was started by the Meyer family in 1918, when Omar E. (OE) Meyer Sr. decided to join his brother in the operation of a welding shop. In the early thirties, Omar Meyer Jr. and his brother August joined their father and renamed the company, O.E. Meyer & Sons. The company grew and began supplying medical gases to area hospitals and the medical community and the selling of welding supplies.

In the 1950s, the company continued to grow expanding in Ohio into Fremont and Galion and in the 1960s into Lorain. Then the company started to broaden their portfolio formally establishing a Medical Division in 1976 hiring specialists to best serve the needs of the health care practitioners, started an Automation Division to serve those who strive for quality machines, and instituted a Home Care Division to serve the rapidly growing outpatient market.

In January 1989, Omar Meyer Jr., made the decision to sell the family-run business to his 57 employees. The Employee Stock Ownership Program (ESOP) business maintained its systems and leadership team, renamed the company O.E. Meyer Co., and leadership transitioned from Omar Meyer Jr. to Rodney Belden as Chairman and CEO and Craig Wood as vice president of the industrial division.

Obviously, this was a huge decision, but it was well thought out with a core of seasoned employees involved in the decision,” stated Eric Wood, EVP and COO, OE Meyer. “It was clear that Mr. Meyer wasn’t able to leave it to family, but he wanted to preserve the company, culture and reward the employees that helped him build the company.

Over the next 20 years, the company continued its growth trajectory under Rodney’s leadership adding locations throughout northern Ohio in Tiffin, Sandusky, Garfield Heights, Bowling Green and Walbridge. In addition, the company reinvested in a new Fill Plant (1999), Bulk Propane distribution (1999) and Beverage CO2 capability (2012). After 26 years in the role of CEO and 48 years of continuous employment with O.E. Meyer, Rodney stepped down and the Board appointed Craig Wood as Chairman of the Board and CEO.

Craig continued the slow and steady growth similar to his predecessors favoring organically growth versus acquisition which resulted in the addition of Colombus location to the footprint. He also continued the trend of investing in the company and its people which included constructing a new state of the art Propane Fill Facility in 2019. “The ‘staying the course’ strategy that my father employed led to consistent growth for the company but was underpinned with a focus on long term planning covering all areas of the business especially succession planning and investments,” stated Eric Wood of OE Meyer. “He also knew when to pivot and make strategic decisions for the benefit of the company, with the exiting of the Home Care business (which had been part of the company a very long time) as a perfect example.” Strategic planning for these types of events is clearly one of the best practices that have continued through the generations.

Eric Wood became the EVP/COO in March of 2023 and together with their management team, consisting of Brian Belden, CEO/President, and Mike Roach, Vice President have continued the tradition of steady growth organically-driven. Similar to other multigenerational FBs, there was a structured plan consisting of both education, work experience and leadership as part of their long term succession planning. He was previously the company’s Chief Operations Officer from January 2021 to March 2023. Before that, he served as Vice President of Sales from 1999 to 2021.

As I enter my 3rd year as part of our leadership team, the strategy remains the same (although the tactics may be different) with us having a clear value proposition for the marketplace,” states Eric Wood. “Bringing value via service/consultation/applications/certified experts/high-end automation solutions in new and creative ways is what will differentiate us from our competitors.

Best Practices (Compass Point)

As seen from the multigenerational FBs reviewed herein, they all executed their business transitions slightly differently across generations using family member(s) leadership, non-family member leadership, partial to 100% ESOPs, and combinations of the previous structures. It demonstrates that there isn’t one structural answer that ensures longevity of FBs. However, at the same time, there were some common themes across all the companies that point to the fact that there are some common traits or best practices across family-owned/led businesses. Compass Point is a company that has seen these operational similarities and practices serving FBs in the Mid-Atlantic region of the US for over 20 years. They believe they have perfected a strategy for aligning ownership, family, and business and below are a few of their recommended best practices:

- Strategic Planning – This tool is foundational for any business who desires to be successful and sustainable across generations, and every family business should have a strategic plan that is shared with all relevant stakeholders, not just family members. This process along with thinking about the interests of the family helps to clarify the mission, vision, values, goals (targets) and strategy {detailed plan} to achieve the goals and fulfill the mission. Business leaders should be mindful that strategic planning in a family-owned business could be influenced by factors such as varying shareholder objectives, limited capital, management succession and family legacy issues. These factors need to be carefully managed to achieve successful outcomes.

A multigenerational FB fully understands the value of strategic planning, because they have seen the results across generations and economic cycles,” states Tom Garrity, Managing Partner of Compass Point. “The focus for them is learning to adjust the process and planning cycle frequency, making it more nimble, agile and timely, since economic cycles are getting shorter and shorter.

- External Perspective – Establishing an Advisory Board made up of both family and non-family members can provide a balanced view of advice for leadership. They are expected to provide strategic guidance to the business and monitor its management by not sacrificing the long-term health of the business for short-term gains. It also provides greater accountability to the executives running the business to ensure that objectives are achieved and also acts as an independent party in addressing difficult issues that could lead to family strife and disputes. External members should be former CEOs or senior execs with broad experience.

- Succession Planning – Can be a complex and challenging process because it often involves different leaders, financial and business objectives, and because each family is unique, there is no one-size-fits-all approach. The process must ensure that the next generation is interested in managing the family business, identify the successor and preparing them for the demands of ownership/leadership, and create an exit plan for the current generation, by addressing difficult conversations instead of avoiding them. “In going through early stages of this process, one of the more difficult parts is coming to the realization that the best person for a key role, may not be the family member,” states Tom Garrity of Compass Point.” That decision often causes family member(s) to elevate their performance for future consideration.”

- Family Constitution – It can be a powerful tool to help drive family alignment and long-term success. Typically outlines a family’s values, vision, mission, standards of conduct, prerequisites for working in the business, as well as other pertinent topics. But it also establishes a family council which provides a framework for dialogue to handle complex family dynamics, managing wealth and making decisions/changes, so that families are building strong relationships across generations. “I’ve seen family constitutions be very detailed and structured whereby the family council meets at least annually to update everyone on changes, business performance, resolve differences, etc.,” states Tom Garrity. “As FBs add new generations of leadership, it appears that many of these longstanding FBs are adopting this approach although implementation may differ widely.”

The list of best practices obviously goes beyond what is captured above and includes additional areas such as proactive financial management, technology savvy, early family member involvement, passing on the entrepreneurial story and so many more. However, the list isn’t stagnant but continues to evolve as competitive, macroeconomic and geopolitical pressures continue to increase. Nonetheless, these multigenerational businesses contained herein have survived and thrived through every major recession, downturn, world war, industry consolidation and catastrophe since the early 1900s, so they are well positioned and confident about their long term futures in the years to come.